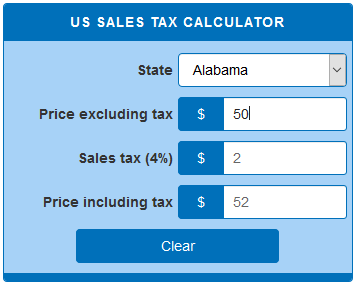

ct tax sales calculator

For a more detailed breakdown of rates. Average Local State Sales Tax.

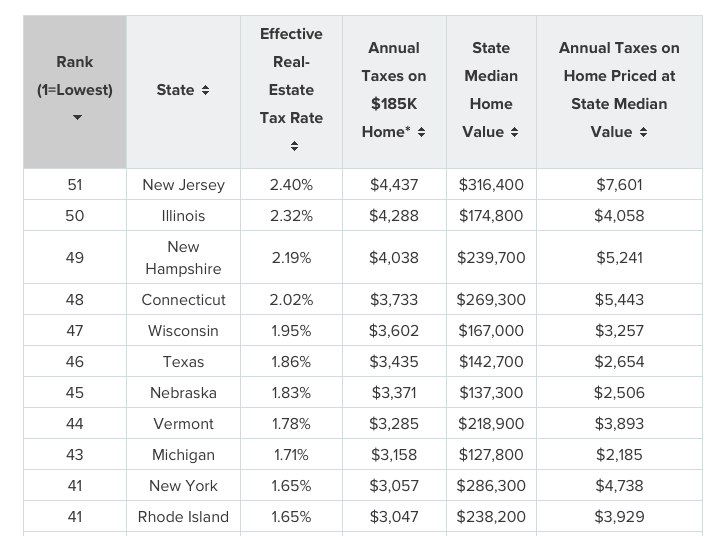

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Find your Connecticut combined.

. How do you calculate gross sales tax. The base state sales tax rate in Connecticut is 635. During 2011 legislation Connecticut passed the enactment of.

Maximum Local Sales Tax. This includes the rates on the state county city and special levels. The calculator will show you the total sales tax amount as well as the.

How to Calculate Connecticut Sales Tax on a Car. Ad Avalara Will Calculate Tax and File Your Sales Tax Returns in 24 States at No Cost to You. Deducting Sales Tax to Find Gross Sales.

This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under. Sales Tax Relief for Sellers of Meals. Exemptions from Sales and Use Taxes.

For a more detailed breakdown of rates please refer to our table below. Your household income location filing status and number of personal. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

Average Local State Sales Tax. Maximum Local Sales Tax. Tax Exemption Programs for Nonprofit Organizations.

Connecticut raised the sales and use tax rate to 635 in July 2011. Ad Sellers use our guide to keep current on all nexus laws and the collection of sales tax. 6 for up to 200000.

The Connecticut CT state sales tax rate is currently 635. Maximum Possible Sales Tax. Usually the vendor collects the sales tax from the consumer as the consumer makes.

Connecticut State Sales Tax. Complete Edit or Print Tax Forms Instantly. Social Security Benefit Adjustment Worksheet.

55 for up to 100000. The sales tax rate in Bedford Connecticut is 635. Maximum Possible Sales Tax.

Average Local State Sales Tax. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 635 in Danbury Connecticut. The minimum is 635.

The sales tax information you need listed by individual states and updated in real time. We allow full trade-in credit when. Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635.

Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are at 299 sales tax rate except for those vehicles that are exempt from sales tax. Sales and Use Tax Information. This Do-it-Yourself Tax Calculator is an online tool that allows you to calculate the approximate impact of tax changes on overall state revenue.

All numbers are rounded in the normal fashion. You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code. Learn About This State-Paid Program That Qualifies Your Business to Automate Tax for Free.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The sales tax rate in the state of Connecticut is 635. Maximum Possible Sales Tax.

Property Tax Credit Calculator. Click here to view the Tax Calculators now. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. So if the sales tax rate is 7 percent divide the total amount of the receipts by 107. Ad Access Tax Forms.

Maximum Local Sales Tax. The starting revenue amounts for the sales. Connecticut State Sales Tax.

Download Or Email CT DRS More Fillable Forms Register and Subscribe Now. If your vehicle was purchased from a licensed dealership the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price. If you are single or married and filing separately the tax rate is 3 for those who make 10000 or less in taxable income.

Connecticut State Sales Tax. 5 for up to 50000. This takes into account the rates on the state level county level city level and special level.

Fillable Online Ct Or 149 Sales And Use Taxes 6 35 Tax Rate Schedule Ct Gov Ct Fax Email Print Pdffiller

Capital Gains Tax Calculator Estimate What You Ll Owe

Office Of The Tax Collector City Of Hartford

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png)

An Overview Of Taxes In New York City

Sales Tax Calculator Credit Karma

Reverse Sales Tax Calculator 100 Free Calculators Io

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

How To Register For A Sales Tax Permit Taxjar

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Calculate Sales Tax Definition Formula Example

Tip Sales Tax Calculator Salecalc Com

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Ct Tax Free Week In Fairfield Aug 21 Through Aug 27 Fairfield Ct Patch

Connecticut Vehicle Sales Tax Fees Calculator Find The Best Car Price

Connecticut Seeks Lost Sales Tax Revenue From Online Sales Connecticut Public

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified